Save Energy at Home

Save Energy at Home

Save energy at home with an Eyedro Home Energy monitor. Take the mystery out of your energy usage with the comprehensive suite of reporting tools in the MyEyedro cloud software. MyEyedro access is included with the purchase of your Eyedro Home Energy monitor with no subscription fees.

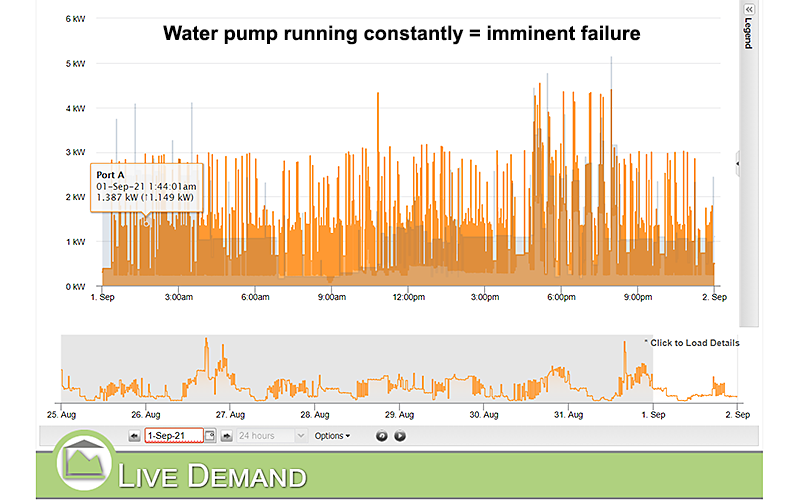

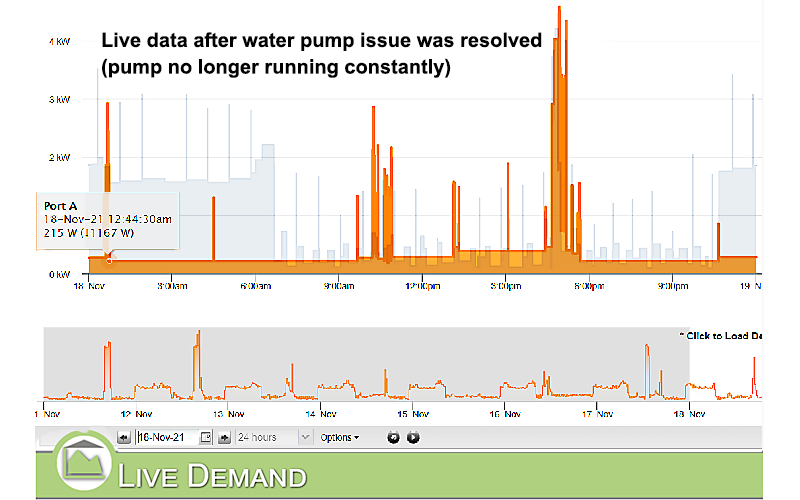

MyEyedro offers a range of insightful options to help you manage your electricity usage. Automated reports can be sent to your email and you can also share reports with additional users. Instantaneous live data will let you know when your energy hogs are running (think clothes dryer, oven, electric heaters), so you can manage the best time for operating these appliances based on your utility times and rates. Real-time data lets you view your live usage as you turn devices off and on. Bills data customized with common utility rate structures are viewable with a 12 month window. Historical data will allow you to track your usage trends over time as you move through the months and seasons and year to year.

Print on demand reports or download your raw data to Excel. MyEyedro offers a myriad of ways for you to view your energy data.

MyEyedro cloud data is integrated with Amazon Alexa, Samsung SmartThings and Google Assistant for added smart home functionality.

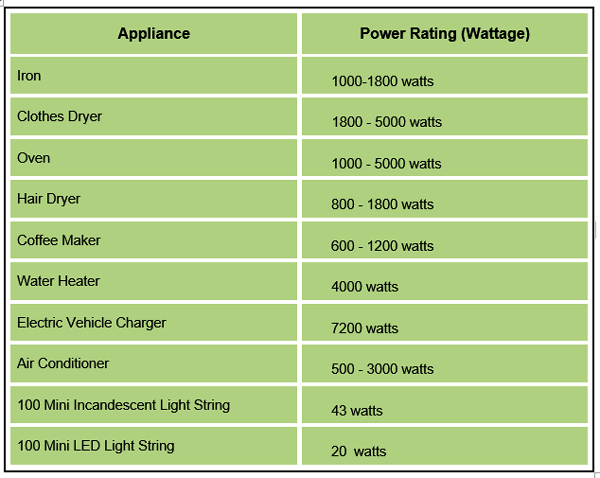

Typical Power Ratings of Your Home Appliances

Phone, internet, water, and energy bills, they all add up. Determining the right mix of service, price, and convenience can help you save money on your utility bills. Eyedro’s real-time energy monitoring can help you make a positive impact on the planet by reducing your home electricity usage. Together, we can combat climate change and create a sustainable future.